does instacart take taxes out of paycheck

Why is there no federal taxes taken out of my paycheck 2022. Every minute spent figuring out your taxes is one more dollar in your pocket.

Instacart Taxes The Complete Guide For Shoppers Ridester Com

The sales tax may be applied to some or all of the items in your order in accordance with local laws.

. This year you expect to receive a refund of all. Everybody who makes income in the US. An Instacart customer left a cash tip causing a debate in a viral TikTok video.

No taxes are taken out of your Doordash paycheck. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. If an item has a refund amount of 000 this means the shopper refunded it.

Does instacart take taxes out of paycheck. In 2022 you can deduct a fixed amount of 585 cents per mile while the rate for 2021. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

For an individual filer in this tax bracket you would have an estimated average federal tax in 2018 of 12. Taxes On 401 Contributions. If youre considered an independent contractor there would be no federal tax withheld from your pay.

As an Instacart driver though youre self-employed. How much does Starbucks take out of your paycheck for taxes. For its part-time shoppers Instacart doesnt take out taxes and they.

Youll sometimes hear this referred to as pre-tax. This is a standard tax form for contract workers. There are a few different taxes involved when you place an order.

To file as an employee simply add the wages from your W-2 to line 1 of your tax return. The amount they pay is matched by their employer. If you wish to claim 1 for yourself instead then less tax.

For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. For most Shipt and Instacart shoppers you get a.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. W-2 employees also have to pay FICA taxes to the tune of 765. By placing a 0 on line 5 you are indicating that you want the most amount of tax taken out of your pay each pay period.

Both employee and employer shares in paying these taxes. Yes - in the US everyone who makes income pays taxes. Instacart processes refunds immediately but they sometimes take 5-10 business days to show.

For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. The sales tax may be applied to some or all of the items in your order in accordance with local laws depending on.

Everyone out there serving for. Has to pay taxes. I worked for Instacart for 5.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. Does Instacart take out taxes for its employees. There are a few different taxes involved when you place an order.

When Does Instacart Pay Me The Complete Guide For Gig Workers

2021 Tax Guide For Grubhub Doordash Uber Eats Instacart Contractors

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

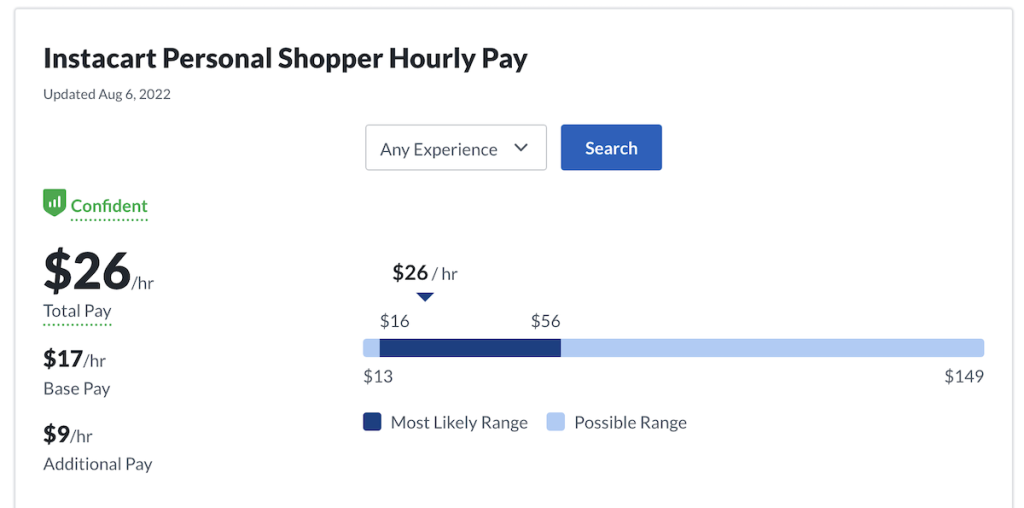

Be An Instacart Shopper Instacart Shopper Pay And Instacart Driver Info

30 An Hour Is How Much A Year Savoteur

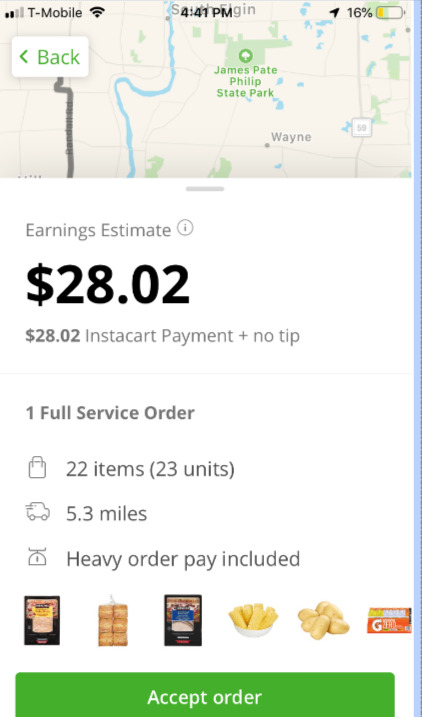

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

How To Handle Your Instacart 1099 Taxes Like A Pro

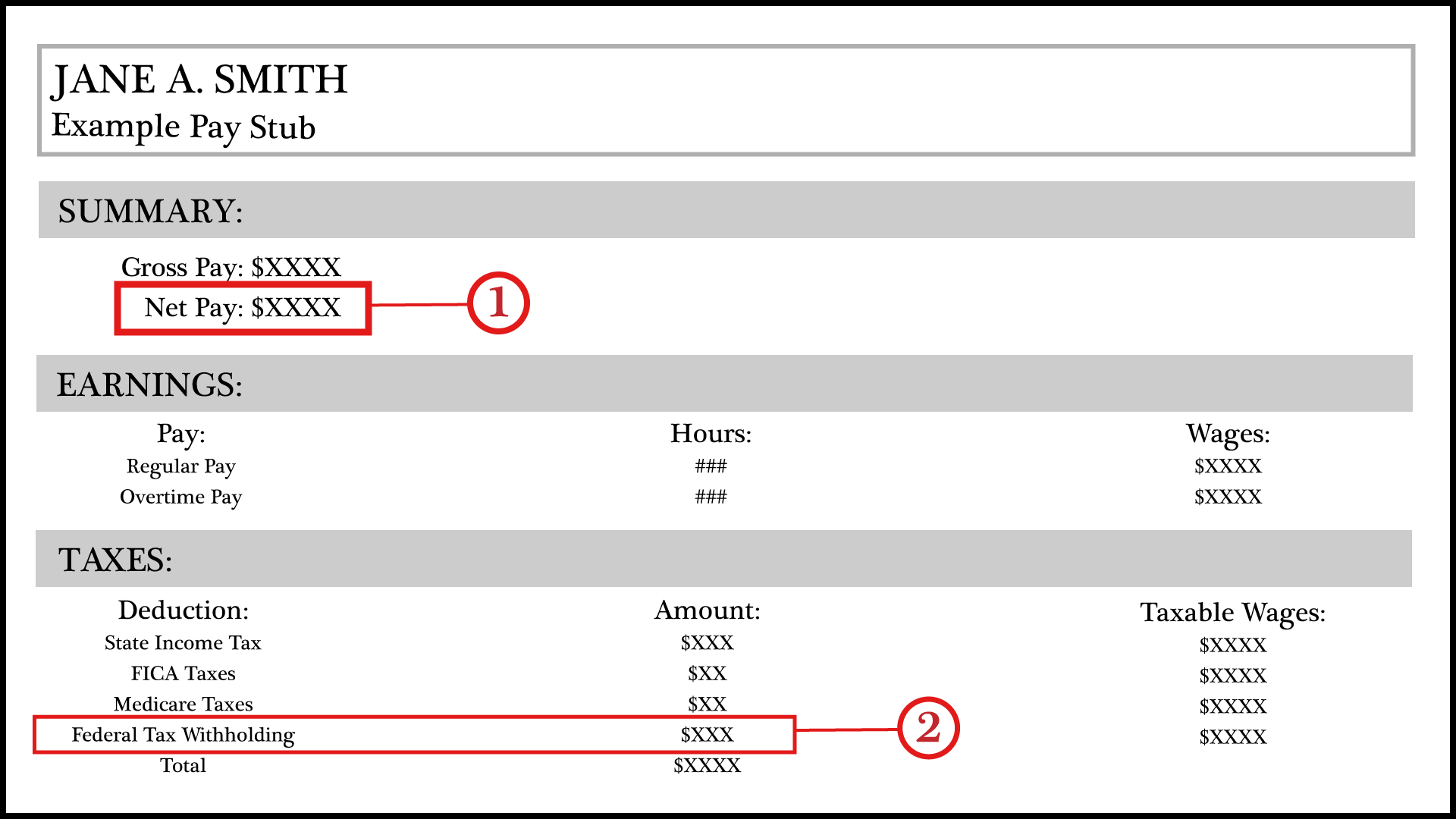

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

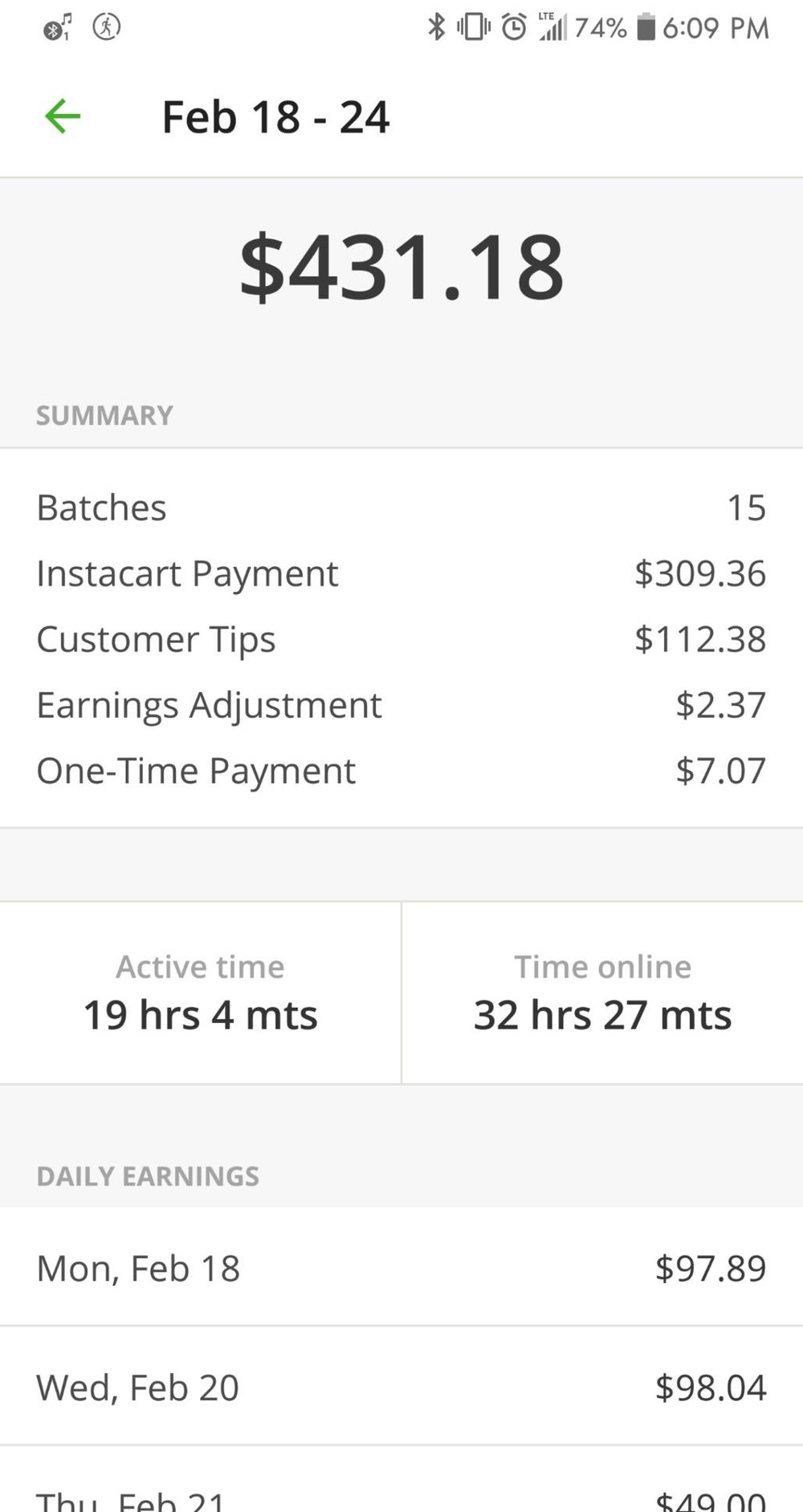

Instacart Driver Review 10k As A Part Time Instacart Shopper

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How Much Money Can You Make In Instacart As A Shopper What Is The Process Like Quora

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

How Much Can You Make With Instacart Learn Pay Rates

Here S How Much Money You Take Home From A 75 000 Salary