capital gains tax increase 2021 uk

The April 2023 increase in corporation tax from 19 to 25 for companies with annual profits in excess of 250000 with a tapered rate between profits of 50000 and 250000 is. The Chancellor is said to be considering increasing the capital gains tax from 20 per cent to up to 45 per cent an increase on fuel duties and raising corporation tax from 19 to 24 per cent a raid on individuals and businesses to pay for the governments coronavirus lockdown spending spree.

Canada Capital Gains Tax Calculator 2022

Capital Gains Tax CGT has been one of the levies discussed.

. Figures from the Treasury released in August show that its Capital Gains Tax receipts. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic.

Individuals have a 12300 capital gains tax allowance. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. If you own a property with a partner you both get that personal capital gains tax allowance.

The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. In other words the first 24600 of profit you can get tax-free.

The changes in tax rates could be as follows. Unregulated Investment Schemes Remain a Threat to Investors. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time. Or could the tax rate be retroactively applied to the 202122 tax year. So for the first 12300 of capital gain you could take that money completely tax-free.

Gains from selling other assets are charged at 10 for basic-rate taxpayers and 20 for higher-rate taxpayers. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED.

This could result in a significant increase in CGT rates if this recommendation is implemented. 10 on assets 18 on property. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

Youll only need to pay these rates. What the property tax rate is. You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance called the Annual Exempt Amount.

Tue 26 Oct 2021 1157 EDT First published on. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax. UK records 44917 new cases.

Proposed changes to Capital Gains Tax. The content of this. Add this to your taxable.

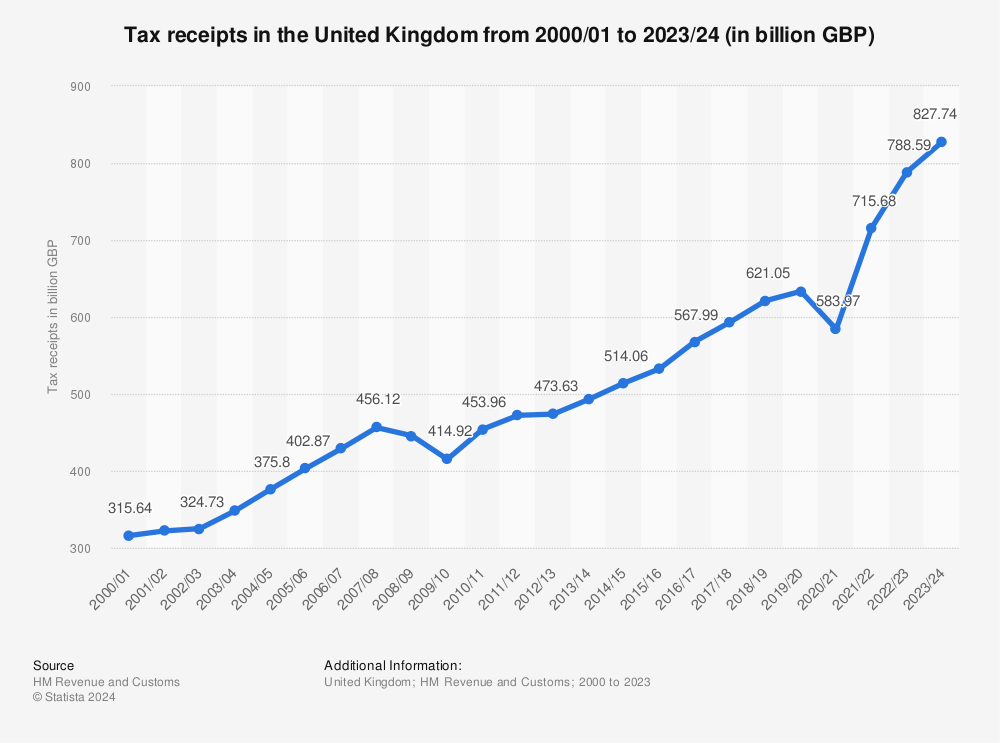

Will capital gains tax increase at Budget 2021. CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax Simplification OTS to look at how this tax could be reformed. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019.

Following Uncle Sam and What It Means for UK Entrepreneurs. Capital Gains Taxes and When They Apply - Omnistar Financial 1 day ago Feb 17 2021 What are Capital Gains Taxes. Implications for business owners.

Labour has indicated it would increase taxes on earnings made from. The maximum UK tax rate for capital gains on property is currently 28. Capital gains tax rates for 2022-23 and 2021-22.

Taxes united-kingdom capital-gains-tax capital-gain. Each year at the moment there is a personal capital gains tax allowance. 20 on assets and property.

Its the gain you make thats taxed not the. Will capital gains tax rate increase in 2021 Wednesday July 27 2022 Edit. 20 28 for residential property for your entire capital gain if your overall annual income is above the 50270 threshold.

UK Budget 2021 06 March 2021. The proposed capital gains tax reforms of which any Budget. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

It is unlikely to be a controversial reform to the majority of the UK population given that. First deduct the Capital Gains tax-free allowance from your taxable gain. The Chancellor will announce the next Budget on 3 March 2021.

20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic. Capital Gains Tax rates in the UK for 202223.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. Aside from increasing taxes the Mr. The OTS review of CGT published in November suggested four key changes as part of an overhaul.

OTS review into capital gains tax CGT it was thought that an increase in CGT rates could well be on the cards. The Capital Gains tax. Strict restrictions for unvaccinated come into effect in Greece.

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting

Follow Tax Justice Uk S Taxjusticeuk Latest Tweets Twitter

Khrom Capital Killed It During The First Quarter Continuing Its Strong Track Record Here Are Their Favorite Stocks Investing Value Investing Value Stocks

The Complete Guide To The Uk Tax System Expatica

Where Carbon Is Taxed Overview

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

The Growing Cost Of The Royal Family To U K Taxpayers Infographic

Cleartax S Infographic Of What Incomes And Losses The Different Itr Forms Include And Exclude Residual Income Business Income Tax Return Website Income

Budget Summary 2021 Key Points You Need To Know Budgeting Business Infographic Income Support

Airport Security Market Size Share Forecast Report 2022 2028 Airport Security Marketing Perimeter Security

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

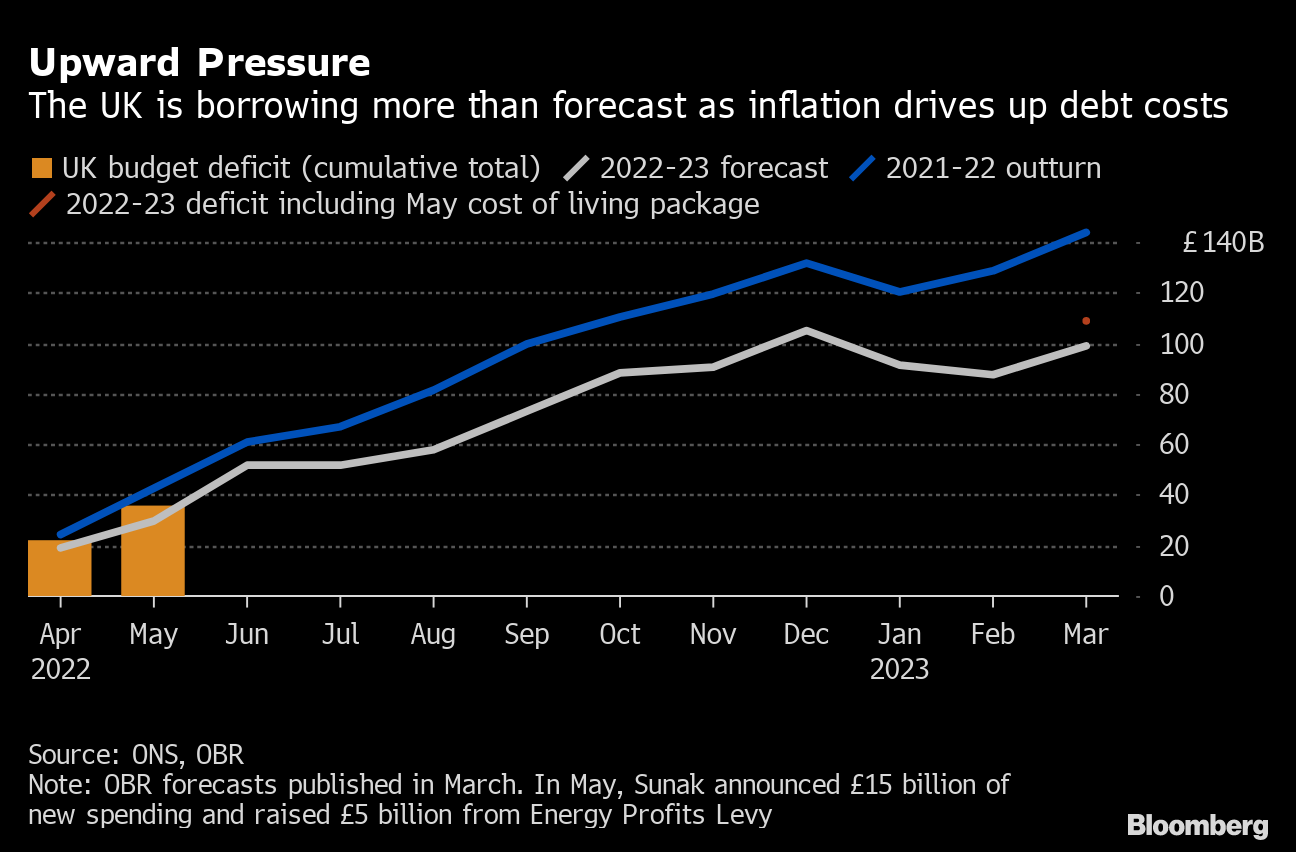

Uk Economy At Heart Of Debate As Truss And Sunak Trade Blows Bloomberg

Wealth 4 India Wealth Online Taxes Audit Services

Raising Rent Is Dave Ramsey Wrong Video In 2022 Dave Ramsey White Coat Investor Ramsey

Top 10 Highest Paid Athlete In The World 2021 Https Www Moneyinternational Com Top 10 Highest Paid Athlete 2021 Athlete Kylian Mbappe Mohamed Salah Liverpool